December 2025

RelevaBio

Neuropathic Pain Cell Therapy Spin-Out Conceptualization and Evaluation

Entrepreneurship in Healthcare & Life Science – Final Project

Overview

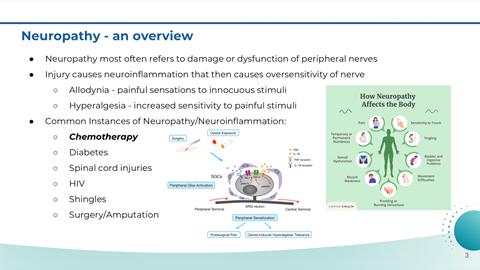

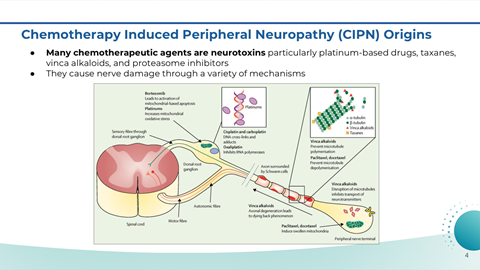

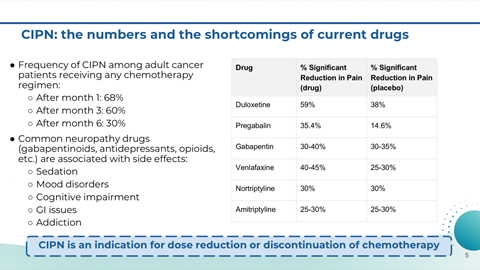

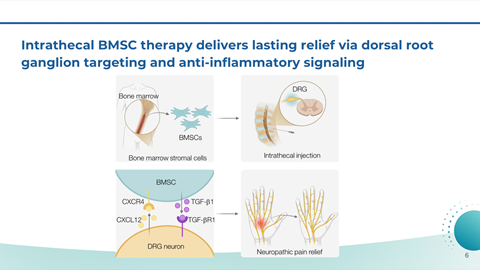

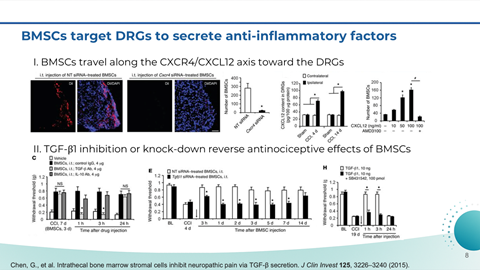

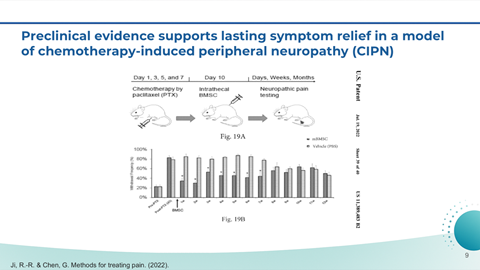

RelevaBio is a university spin-out concept based on bone marrow stromal cell (BMSC) therapy for chronic neuropathic pain, with initial focus on chemotherapy-induced peripheral neuropathy (CIPN). This project evaluates the translational viability of the technology across science, regulation, and economics. The underlying technology evaluated for commercialization was developed by Ru-Rong Ji at Duke University.

Core Question

Whether a cell therapy approach can deliver durable neuropathic pain relief while meeting regulatory, manufacturing, and payer constraints.

Scope of Work

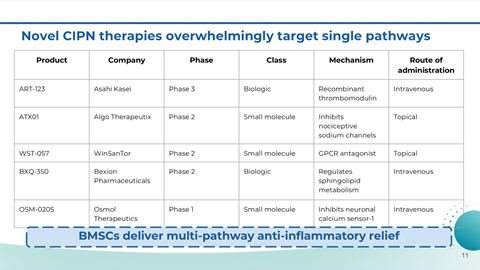

Translation of academic pain biology into a therapeutic development thesis

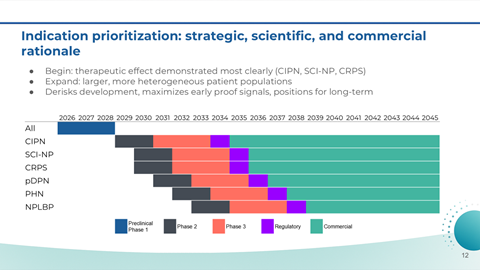

Indication prioritization across multiple neuropathies

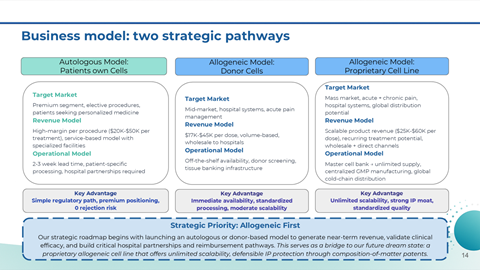

Comparison of autologous, donor-based, and allogeneic development pathways

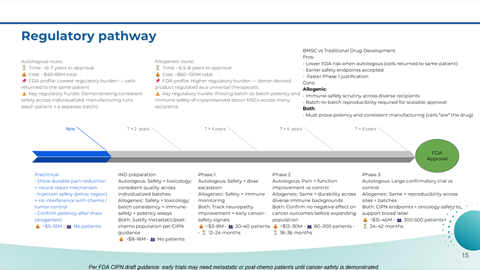

Regulatory strategy for intrathecal cell therapies

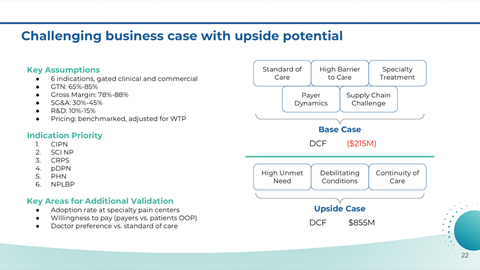

Construction of base-case and upside DCF and rNPV financial models

Project Insights

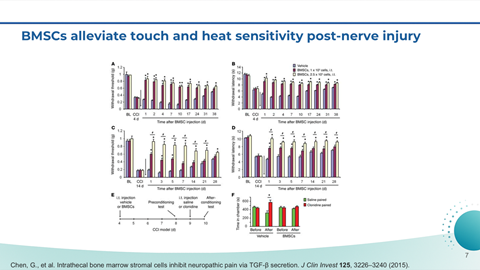

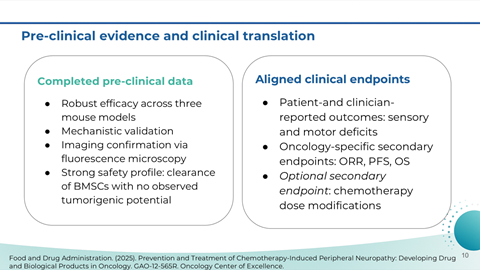

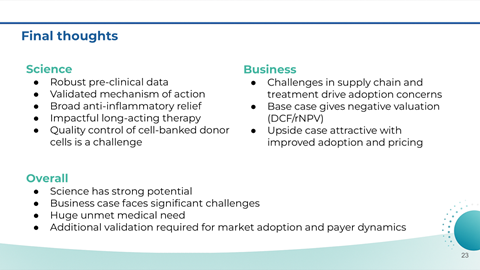

Strong preclinical rationale with meaningful unmet clinical need

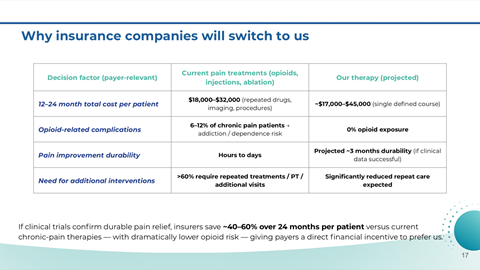

Significant sensitivity to adoption friction, delivery complexity, and payer dynamics

Autologous approaches de-risk early approval but limit scalability

Allogeneic approaches offer upside with higher capital and execution risk

Why This Work Matters

This project reflects how early-stage biotech opportunities must be evaluated with scientific rigor and commercial realism, rather than narrative-driven optimism.

My Role

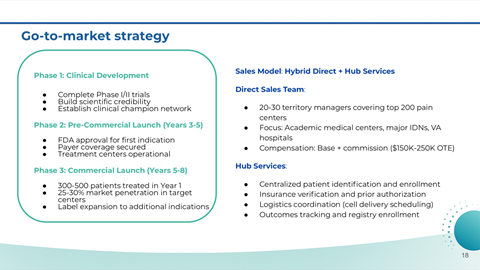

Led commercialization strategy and indication prioritization

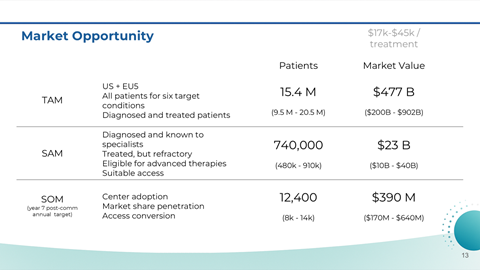

Developed market builds and estimated market sizing

Built financial models and risk-adjusted valuation cases

Co-authored final investment and development recommendations