This scientific and business case evaluation was completed as part of the Entrepreneurship in Healthcare and Life Science course at Chicago Booth taught by serial entrepreneur Brian Coe.

The company evaluation deck can be found here.

October 2025

Kyverna Therapeutics

Scientific and Business Case Evaluation

Entrepreneurship in Healthcare & Life Science – Midterm

Overview

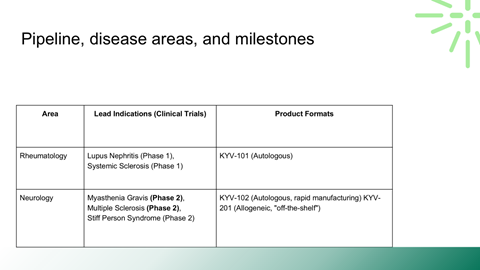

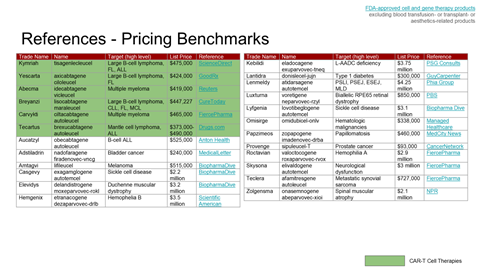

This project is a fundamental evaluation of Kyverna Therapeutics, a publicly traded biotechnology company developing CAR-T cell therapies for severe autoimmune diseases. The work mirrors a public equity research process rather than a venture pitch.

Analytical Focus

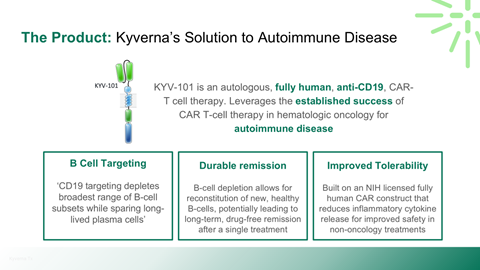

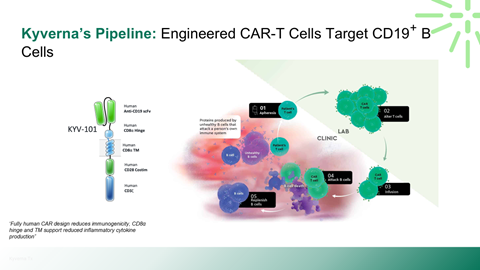

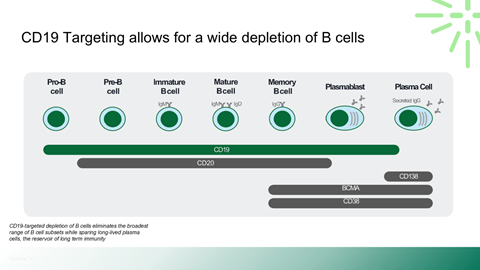

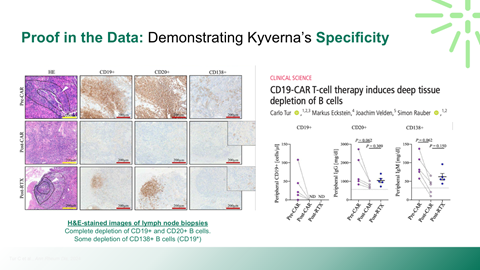

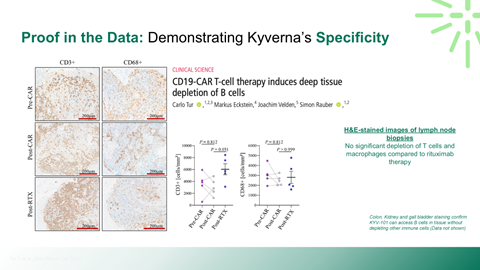

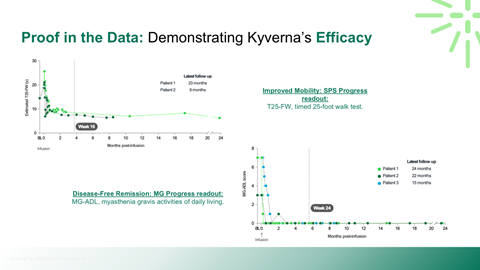

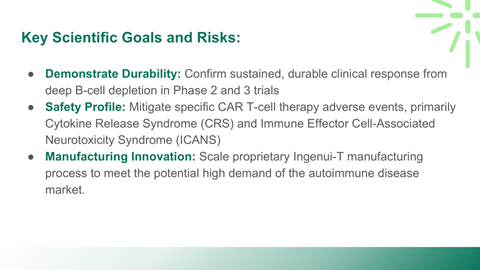

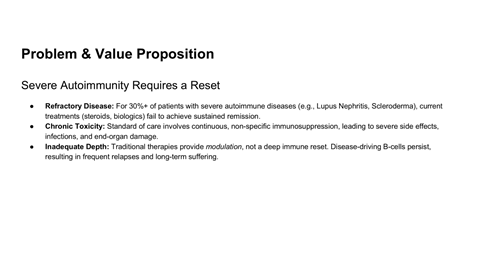

Scientific rationale for applying CAR-T therapy beyond oncology

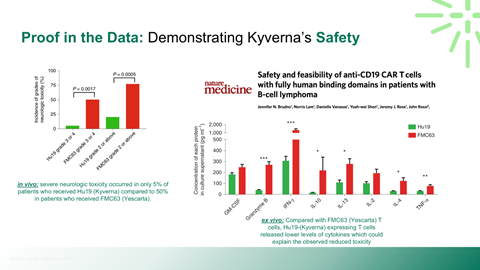

Safety, durability, and relapse risk associated with deep B-cell depletion

Manufacturing scalability as a commercial constraint

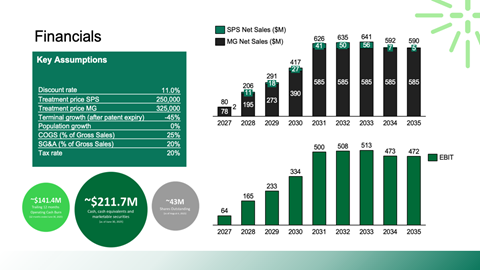

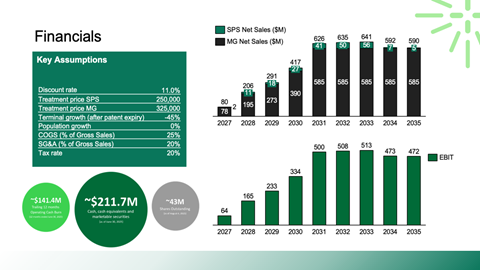

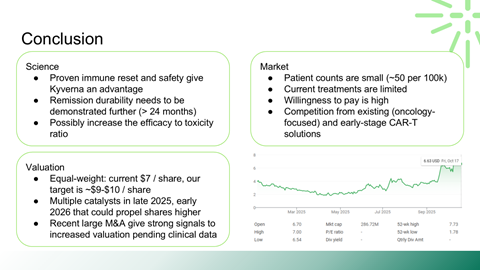

Valuation sensitivity to upcoming clinical and regulatory catalysts

Scope of Analysis

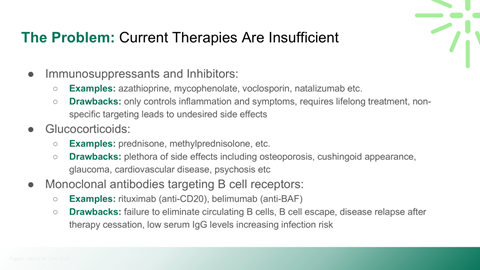

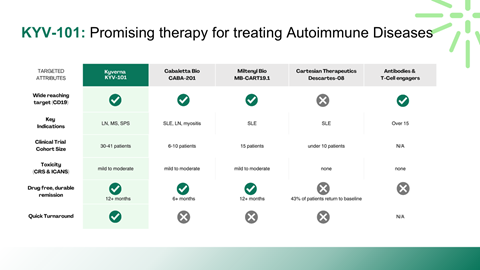

Mechanism of action and differentiation versus existing biologics

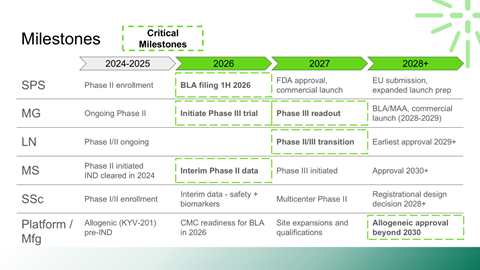

Interpretation of Phase II clinical data and transition risks to Phase III

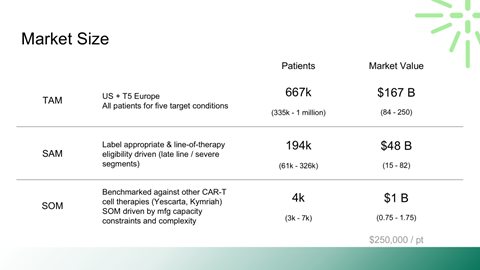

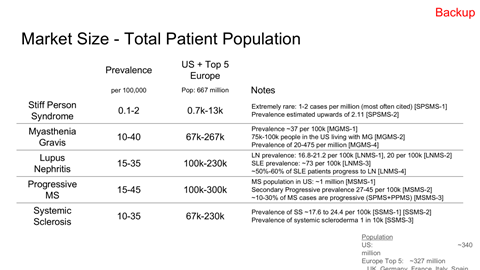

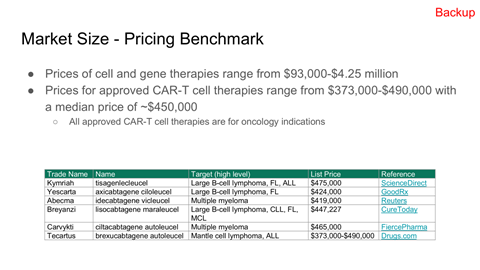

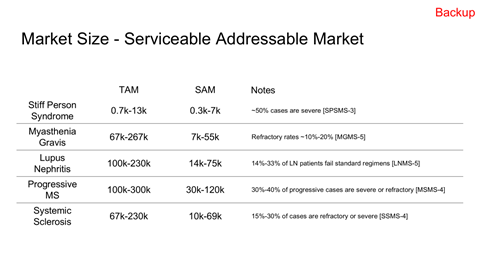

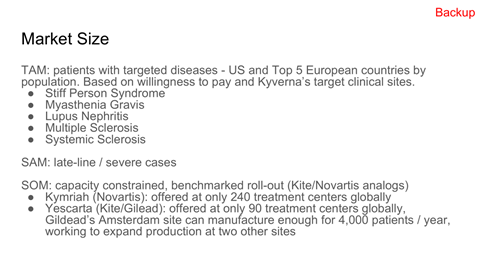

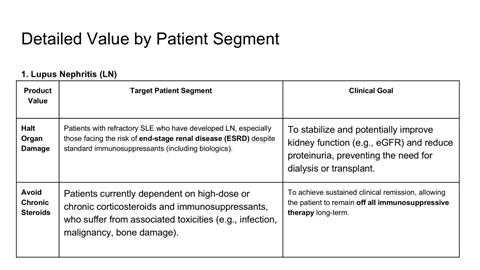

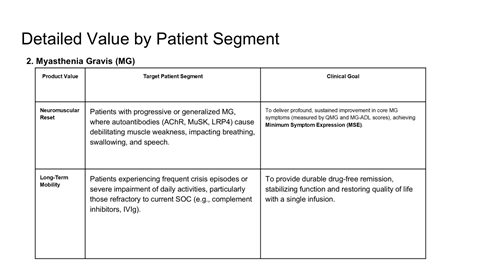

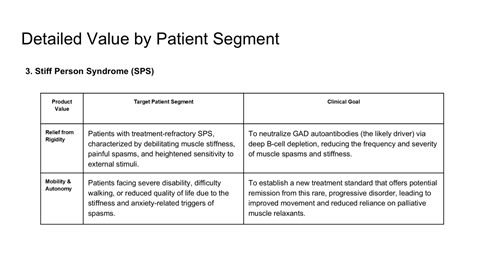

TAM, SAM, and capacity-constrained SOM modeling

Valuation framing using public comparables and precedent transactions

Why This Work Matters

Advanced cell therapies often attract enthusiasm that outpaces evidence. This analysis demonstrates a disciplined approach to evaluating cutting-edge science while grounding conclusions in clinical data, manufacturing realities, and capital markets behavior.

My Role

Led business case evaluation

Built market sizing and capacity-constrained adoption assumptions

Contributed to valuation framing and investment conclusion

Synthesized findings into an scientific and business case assessment